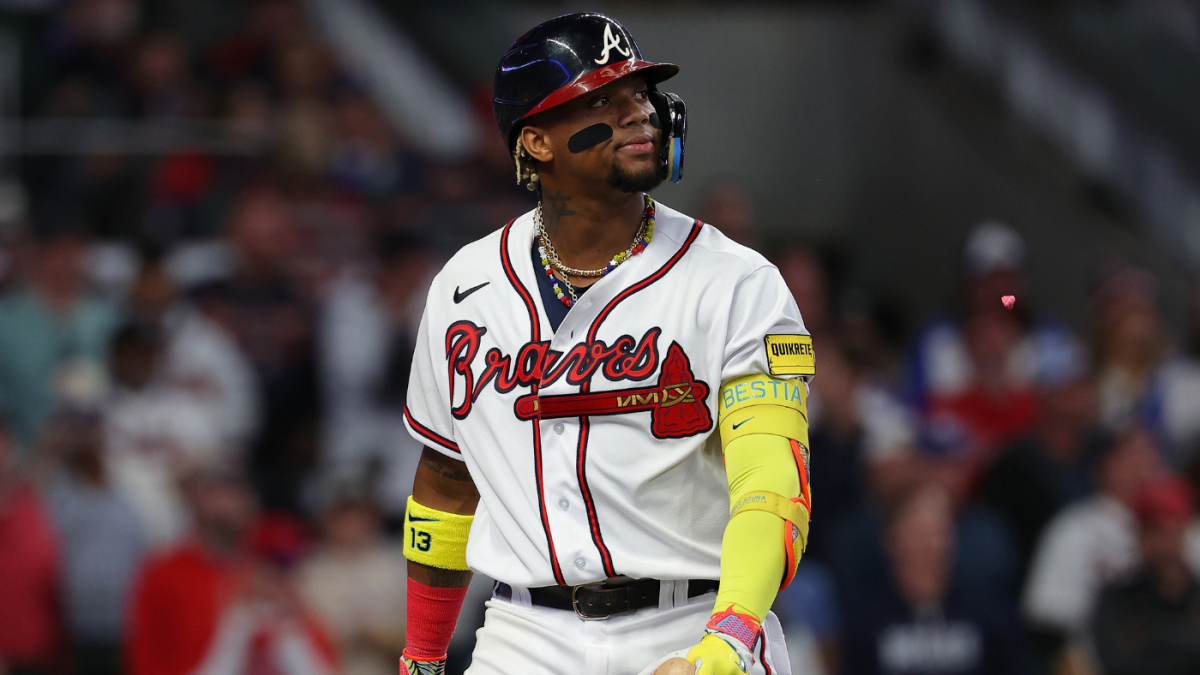

The Atlanta Braves find themselves facing a quietly looming dilemma involving superstar outfielder Ronald Acuña Jr.. While the issue will not impact their immediate plans for the upcoming season, it casts a long shadow over the franchise’s future beyond 2026. Acuña, now 28 years old and entering what should be the prime stretch of his career, remains tied to the team under a contract that runs through this season with club options for 2026 and 2027—terms that currently stand as one of the most team-friendly deals in baseball for a player of his caliber.

The conversation surrounding Acuña’s long-term future intensified this week after Buster Olney joined 92.9 The Game to address the growing uncertainty. Olney’s analysis offered a revealing look at how Alex Anthopoulos, the Braves’ president of baseball operations, historically approaches expensive contract decisions. His remarks suggested that Atlanta’s leadership remains cautious about committing elite-level money to players who command enormous market value—especially when durability concerns exist.

Olney emphasized that Acuña’s situation carries multiple layers. While he is undeniably one of the most dynamic talents in baseball when fully healthy, he has also experienced multiple injury-plagued seasons. Those injuries complicate both his market value and Atlanta’s long-term strategy. Olney pointed out that the Braves prefer to extend players early, securing them on deals that offer long-term organizational stability without reaching the stratospheric figures commonly associated with superstars like Shohei Ohtani, Juan Soto, or Kyle Tucker.

He explained that once players reach a certain financial tier—one that positions them among the highest earners in the sport—Atlanta typically operates with restraint. The Braves, he said, do not enter bidding wars driven by massive market inflation. Instead, they prioritize deals that provide value over spectacle. If a player’s contract expectations exceed those parameters, the organization often moves on rather than stretching beyond its disciplined financial model.

This measured philosophy fuels the uncertainty surrounding Acuña’s future. Atlanta unquestionably wants him healthy and productive, but those very factors could also make him prohibitively expensive when his next contract negotiation arrives. Acuña possesses MVP-level talent, elite athleticism, and the type of star power few franchises can replace. But the Braves’ track record suggests they might be unwilling—or unable—to match the mega-contract he is likely to command if he continues performing at his usual pace.

There is no questioning Acuña’s ability when he is at full strength. The 2023 NL MVP remains one of baseball’s most electrifying players, boasting a career slash line of .289/.384/.524 across 817 games. He is a three-time Silver Slugger, a two-time NL stolen base champion, and one of the most feared offensive forces in the league. His blend of power, speed, and elite on-base skills makes him a generational talent capable of impacting games in every possible way.

However, durability has been a recurring concern. Acuña has not completed a full season since 2023, and three of his seven MLB seasons ended with fewer than 100 games played (excluding the shortened 2020 season). These interruptions have raised questions about how long he can maintain peak performance—and whether a franchise can justify a massive long-term financial commitment to a player with such a history.

For 2026, Acuña will earn $17 million, with each club option carrying the same value. From a team perspective, these terms are incredibly favorable, giving Atlanta high-level production at a fraction of the cost paid for other premier outfielders. But that dynamic will not last forever. Once Acuña reaches free agency—or even approaches it—his price will skyrocket if he continues producing at an elite level.

Recent contracts across the league highlight how dramatically the market has shifted. This offseason, Tucker secured a four-year, $240 million deal from the Los Angeles Dodgers, averaging $60 million per year—currently the second-highest AAV in baseball behind Ohtani. Given Acuña’s consistent dominance when healthy, it is not unreasonable to project his next contract falling within a similar financial framework.

Olney’s comments strongly hinted that Atlanta would balk at such figures. The Braves have repeatedly shown that they are unwilling to engage in high-end superstar bidding, instead focusing on early extensions and long-term planning. While they would undoubtedly love to retain Acuña, they are not expected to deviate from their disciplined strategy—even for a player of his magnitude.

Acuña’s future, therefore, may hinge on variables beyond performance. If injuries continue to limit his availability, he may be forced to consider a more modest extension—potentially one that aligns with Atlanta’s budget and keeps him in the city he has called home since his teenage years. Alternatively, he could choose to prioritize organizational loyalty and take a hometown discount, leaving money on the table for the chance to finish his career with the franchise that developed him.

But if Acuña posts another dominant stretch of seasons and enters the open market at full strength, he could easily price himself out of Atlanta’s plans. The Braves, facing the challenge of building around a long-term core without surpassing their financial comfort zone, may have no realistic option but to prepare for life without their superstar.

The conversation remains hypothetical for now, but the pressure is rising in Atlanta. While the organization is focused on winning in the present, the future of Ronald Acuña Jr.—once seemingly a long-term certainty—has transformed into one of the most intriguing questions looming over the franchise.