The Atlanta Braves have quietly assembled one of the more deliberate and calculated offseasons in baseball, and Saturday marked another significant step as the organization moved to further solidify its bullpen for the 2026 campaign.

After an early flurry of relief-focused signings, Atlanta experienced a brief lull in activity, but that pause ended with another targeted addition aimed at reinforcing one of the roster’s most critical components.

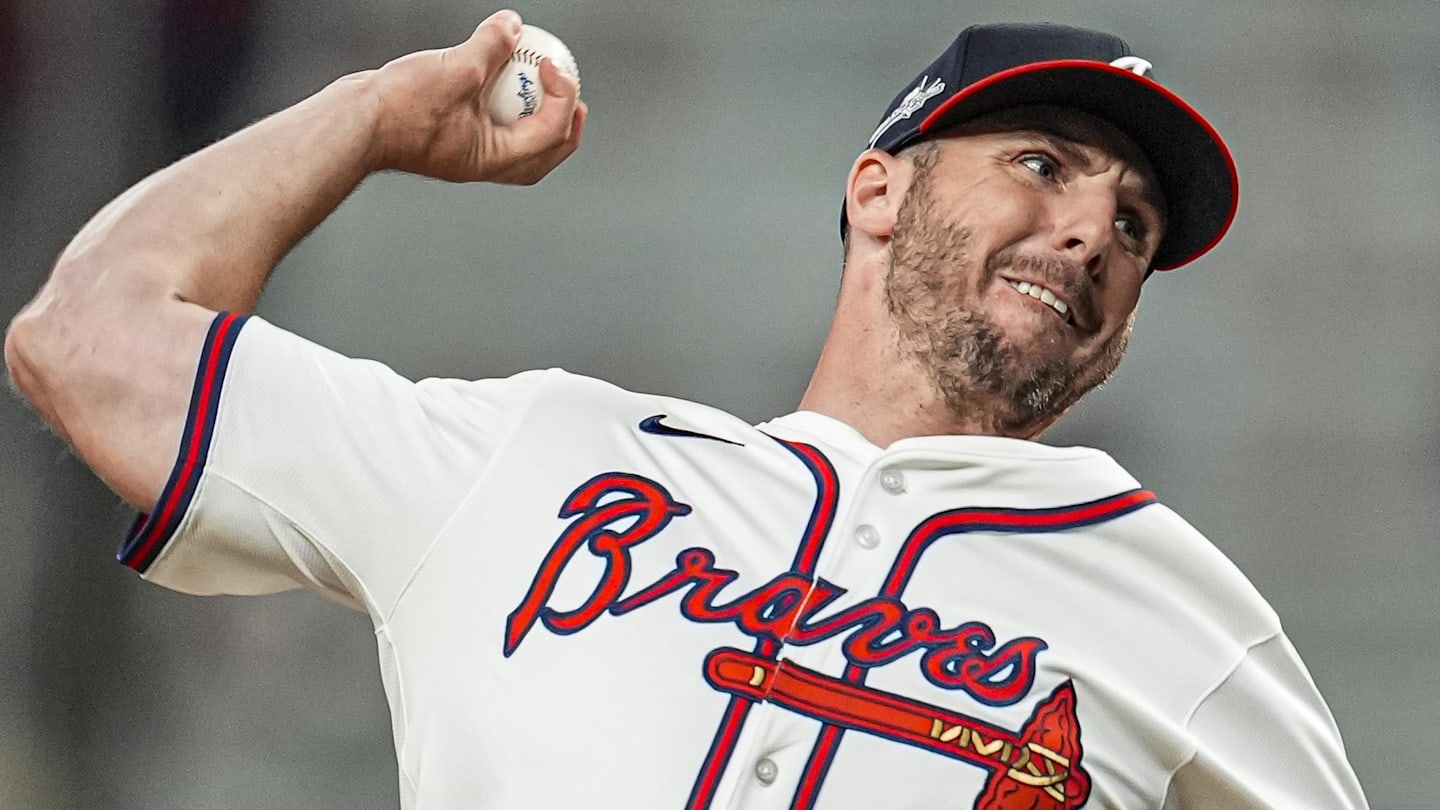

According to Will Sammon of The Athletic, the Braves have agreed to a one-year deal with veteran reliever Tyler Kinley, adding depth and continuity to an already expensive relief corps.

The contract is worth $4.25 million for the 2026 season, with Kinley set to earn a $3 million base salary as part of the agreement.

The deal also includes a $5.5 million club option, giving Atlanta flexibility should Kinley’s performance decline or roster needs shift over the next year.

That structure reflects a broader trend in the Braves’ bullpen strategy, blending financial commitment with built-in safeguards against regression.

Atlanta originally acquired Kinley from the Colorado Rockies at the July trade deadline, a move that quietly paid immediate dividends.

Upon arriving in Atlanta, Kinley delivered one of the strongest stretches of his career, quickly earning trust in high-leverage situations.

With the Braves in 2025, Kinley posted an exceptional 0.76 ERA across 25 innings, a dominant run that largely explains the organization’s willingness to bring him back.

That performance contrasted sharply with the volatile environment he left behind, offering a glimpse of what Kinley could be outside of Colorado’s challenging pitching conditions.

Across the full 2025 season, split between Atlanta and Colorado, Kinley recorded a 3.96 ERA over 72.2 innings and 73 appearances.

Those totals underscore his durability, an increasingly valuable trait in a league where bullpen attrition has become routine.

Kinley’s availability allowed managers to deploy him frequently without sacrificing effectiveness, a balance few relievers consistently achieve.

Now entering his ninth major league season, Kinley brings experience that extends well beyond the stat sheet.

He spent six seasons with the Rockies before his trade to Atlanta, navigating one of baseball’s most unforgiving pitching environments.

At 34 years old, Kinley is likely relieved to have permanently exited Coors Field, where altitude and ballpark dimensions amplify even minor mistakes.

Over the years, that environment contributed to several inflated ERA seasons, including multiple campaigns where his ERA crept into the mid-6.00 range.

However, those surface numbers often obscure the broader context of pitching in Denver.

Evaluating Kinley’s performance away from Colorado paints a more nuanced picture.

For example, during the 2024 season, he posted a 5.74 ERA on the road over 31.1 innings, hardly dominant but still reflective of league-average relief performance.

The Braves’ pitching infrastructure appears to have unlocked something more consistent, whether through pitch usage, sequencing, or mechanical refinement.

Atlanta has built a reputation for maximizing veteran relievers, a factor that likely influenced Kinley’s willingness to remain with the organization.

With Kinley now officially re-signed, Atlanta’s 2026 bullpen appears largely set barring unexpected trades or roster upheaval.

That stability is notable, particularly given the financial investment the Braves have poured into their relief corps this offseason.

The spending began with the re-signing of incumbent closer Raisel Iglesias, who returned on a $16 million deal.

That move preserved continuity at the back end of the bullpen, where Iglesias has provided consistent late-inning dominance.

Atlanta then added Joel Payamps on a modest $2 million contract, a value-driven addition aimed at middle-inning depth.

The most aggressive move came with the signing of Robert Suarez to a three-year, $45 million deal, signaling Atlanta’s intent to assemble an elite relief unit.

Suarez’s contract represents a significant financial commitment, positioning him as a central figure in the bullpen hierarchy.

With Kinley’s signing now complete, the Braves have effectively locked in their primary bullpen structure.

On the left-handed side, the group is expected to include A.J. Minter, Dylan Lee, and potentially Dylan Dodd.

Those options provide balance and matchup flexibility against left-heavy lineups.

On the right-handed side, the core will feature Payamps, Iglesias, Kinley, and Suarez.

The final bullpen spot could come down to either Grant Holmes or Bryce Elder, depending on spring performance and rotation needs.

That depth gives the Braves multiple configurations, allowing them to adapt based on opponent and game state.

For newly appointed manager Walt Weiss, the bullpen offers a blend of experience and flexibility.

Weiss inherits a relief group capable of handling high-leverage situations without excessive workload concentration.

That balance could prove critical over the course of a long season, particularly given Atlanta’s postseason aspirations.

The emphasis on bullpen spending reflects a broader organizational philosophy.

In recent years, the Braves have prioritized shortening games, leveraging strong starting pitching into reliable late-inning execution.

The 2026 bullpen appears designed to continue that model, reducing reliance on starters deep into games.

However, the success of this approach hinges on health, particularly among the highest-paid relievers.

Atlanta will need consistent availability from Iglesias and Suarez to justify their contracts.

Kinley’s deal, by contrast, carries minimal long-term risk, offering value if his performance mirrors his 2025 stretch in Atlanta.

Even modest regression would likely still position him as a serviceable middle-inning option.

The Braves’ bullpen spending also reflects competitive pressures within the National League.

With multiple contenders investing heavily in relief pitching, Atlanta appears determined not to fall behind in late-game matchups.

The Kinley signing may not generate headlines, but it reinforces a bullpen built for sustained success rather than short-term flash.

From a roster-construction standpoint, the move also signals confidence in the rest of the team.

Atlanta’s front office appears comfortable allocating resources to the bullpen, suggesting belief in the current core of position players and starters.

That confidence is essential for a club aiming to remain among baseball’s elite.

As the offseason progresses, Atlanta could still explore marginal upgrades, but the foundation is firmly in place.

Barring injuries or unexpected trade opportunities, the Braves’ bullpen will enter 2026 as one of the league’s deeper units.

For Kinley, the deal offers stability and a chance to extend his effectiveness in a more forgiving environment.

For Atlanta, it represents another calculated move in an offseason defined by targeted spending rather than dramatic overhaul.

As spring training approaches, the Braves can turn their attention toward refining roles rather than filling gaps.

That clarity could provide a competitive edge, allowing the team to focus on execution rather than uncertainty.

In a league where bullpen volatility often derails otherwise strong teams, Atlanta’s proactive approach may prove decisive.

The Kinley signing may not dominate headlines, but it fits seamlessly into a broader strategy built on depth, durability, and flexibility.

For the Braves, that formula has worked before, and they appear intent on doubling down as they look toward the 2026 season.