The New York Mets entered the 2025 campaign with sky-high expectations, and for a brief moment in early summer, they looked every bit like the juggernaut their front office had envisioned when reshaping the roster.

Through June, the Mets held the best record in baseball, riding elite offensive production, strong pitching, and an electric home atmosphere at Citi Field that brought renewed hope across Queens.

But as the season shifted into the second half, injuries, inconsistency, and a sudden collapse erased their early momentum, leaving them out of the postseason picture and fueling yet another winter of what-ifs and unanswered questions.

Even so, the on-field disappointment did not prevent the franchise from delivering a historic year financially — a year driven by superstar power, massive fan turnout, and unprecedented revenue totals.

The centerpiece of the Mets’ business explosion was the signing of superstar outfielder Juan Soto to a record-breaking 15-year, $765 million contract — the largest financial commitment in MLB history.

Soto brought instant credibility, immediate excitement, and a jolt of star power unmatched in the sport, transforming the Mets’ brand almost overnight and generating a wave of national attention.

Fans packed Citi Field at historic levels to watch the 26-year-old phenom anchor the lineup, with his arrival creating a ripple effect across attendance, merchandise sales, sponsorships, and premium seating interest.

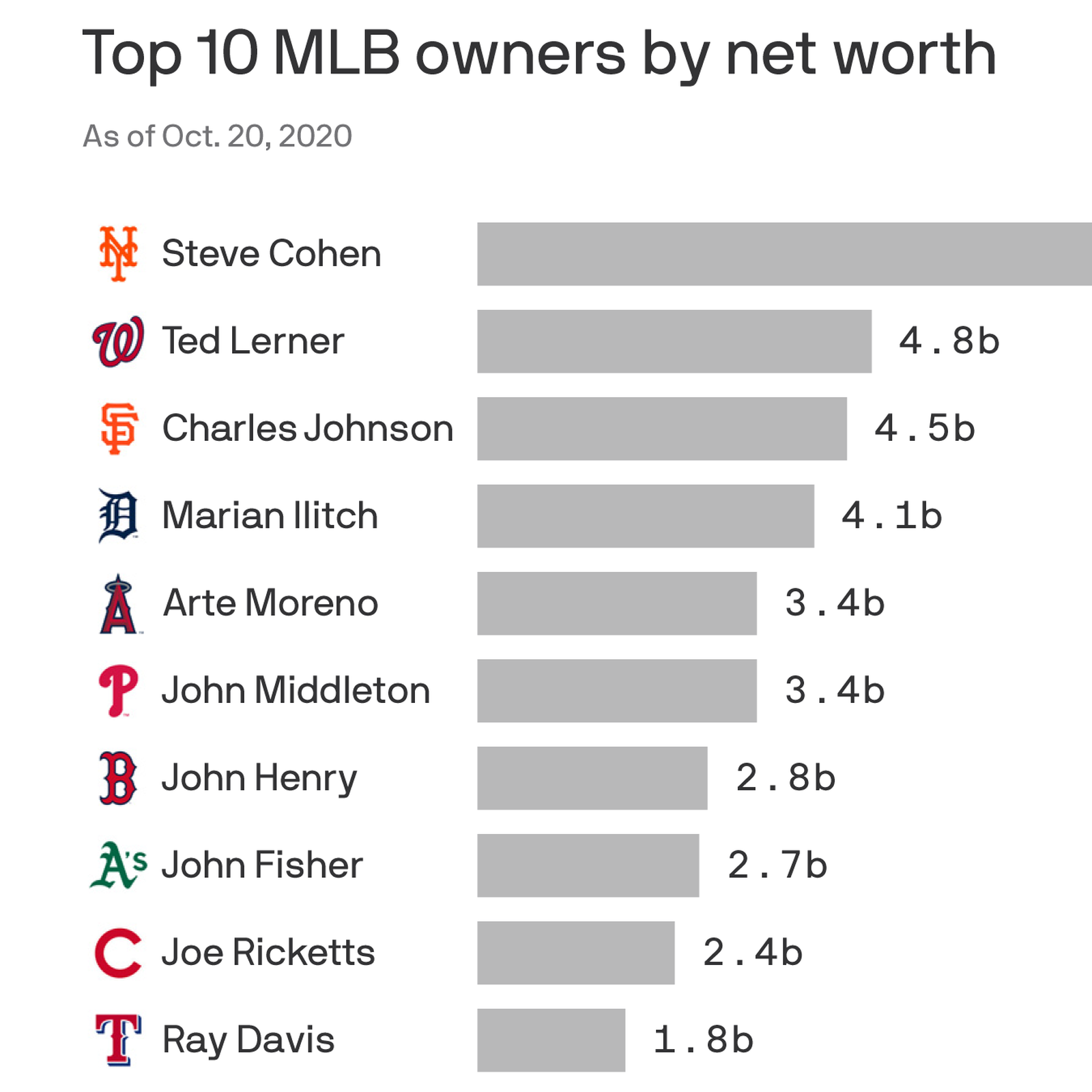

The Soto signing signaled the full might of owner Steve Cohen’s financial ambitions and positioned the Mets as one of baseball’s most glamorous destinations.

According to required financial disclosures linked to Citi Field’s construction financing, Queens Ballpark Company generated $311.4 million in revenue during the 2025 season, setting a new franchise benchmark for profitability at the ballpark alone.

That figure represents a dramatic jump from $260.8 million in 2024 and $237.8 million in 2023 — proof that the Soto effect, paired with early winning baseball, produced powerful commercial results.

Net ticket revenue surged to $157.6 million — up from $136.7 million — as an astonishing 850,000 additional fans passed through the turnstiles, pushing total attendance to a franchise-record 3.2 million.

It was a landmark season for fan engagement, solidifying Citi Field as one of the premier attractions in MLB and a centerpiece of New York’s booming summer entertainment landscape.

The Mets also expanded premium seating inventory in 2025 — including updates to the Delta Sky360 Club and additional hospitality offerings — resulting in luxury suite and club premium revenue nearly doubling to $39.1 million.

High-end seating sold out frequently, fueled by corporate demand, high-profile matchups, and the magnetism of watching Soto in his prime on a nightly basis.

Concessions revenue also soared, jumping 55% to $38.3 million, as larger crowds, improved food offerings, and expanded vendor partnerships created a more robust game-day economic ecosystem throughout the ballpark.

Every corner of Citi Field benefited from the influx of fans, enhancing the stadium’s value as both a sports venue and a premium entertainment complex.

Parking generated $16 million in additional income, while miscellaneous categories, including events and retail activity, added another $7.7 million — completing a $311 million revenue picture that excludes major external revenue streams.

Notably, the total does not include earnings from the Mets’ regional sports network, SNY, nor their share of MLB’s national media and sponsorship deals.

As a top-revenue franchise, the Mets also contribute to MLB’s revenue-sharing system, yet their ballpark profits still positioned them among baseball’s financial heavyweights despite missing the postseason.

The ballpark thrived even in a season marked by second-half disappointment, demonstrating the staying power of star talent and the loyalty of New York’s vast baseball market.

Operating income for Queens Ballpark reached $167 million, even after accounting for $26.3 million in depreciation and amortization — a robust figure that underscores how powerful the Mets’ brand has become under Cohen’s ownership.

But those ballpark profits tell only part of the story, because the Mets themselves posted staggering financial losses due to Cohen’s unrivaled commitment to aggressive spending and high-end roster construction.

The club reportedly lost more money than any other MLB franchise — over three times as much — thanks to a massive $347 million payroll and a punishing $92 million luxury tax bill triggered by their spending habits.

These losses are not temporary anomalies; they reflect Cohen’s willingness to push the limits in pursuit of championships.

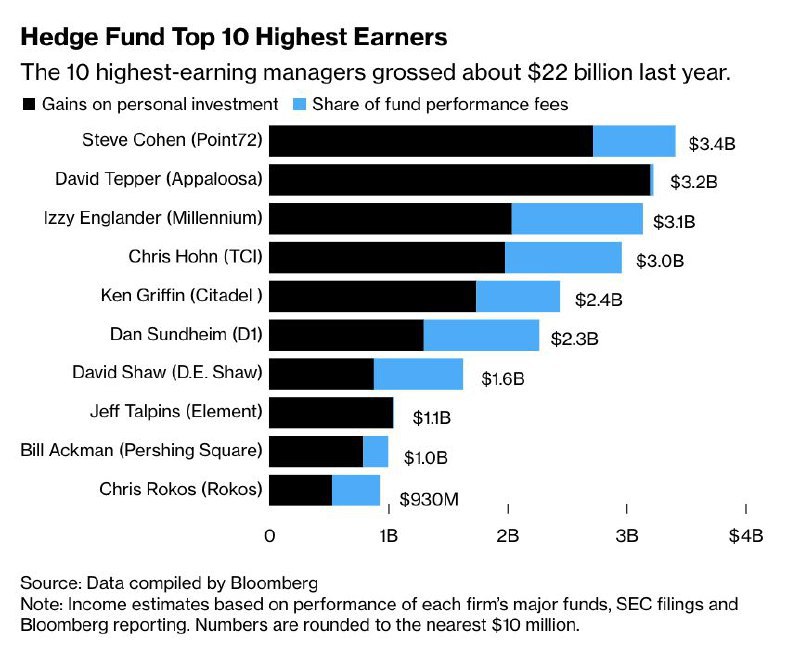

Fortunately for Mets fans, Cohen possesses the financial firepower to absorb such losses with ease, as he earned an estimated $3.4 billion in 2025 through his investment firm, Point72 Asset Management.

That figure dwarfs the Mets’ operating deficit and reaffirms Cohen’s ability to treat the franchise as both a passion project and a long-term investment rather than a traditional profit-maximizing business.

Since acquiring the Mets in 2020 for an MLB-record $2.42 billion, Cohen has signaled repeatedly that financial constraints will never dictate competitive ambition — a philosophy that stands in stark contrast to ownership trends across much of baseball.

His investment approach centers on star power, organizational innovation, and fan experience, all of which have elevated the Mets’ profile dramatically.

Even with postseason heartbreak and a massive financial hit on the baseball side, New York’s off-field momentum remains strong, and the franchise enters the 2026 season with expectations as high as ever.

Soto is just beginning the first chapter of his historic deal, and his presence makes the Mets a magnet for future free agents seeking both competitive opportunity and the bright lights of a major market.

The challenge now is building a roster that can sustain a full six-month push, avoid the second-half collapse that doomed 2025, and produce October baseball that matches the excitement and revenue generated during the summer surge.

Cohen and his front office remain committed to that mission, leveraging unprecedented financial resources to position the team as a perennial contender.

The Mets of 2025 were a paradox — a team that soared early, stumbled late, missed the postseason, yet still produced one of the most financially dominant seasons in franchise history thanks to brilliant marketing, superstar acquisition, and loyal fan support.

Their journey now shifts to 2026, where the mandate is clear: transform financial success into on-field results, turn Soto’s superstardom into postseason victories, and deliver the championship ambition that Cohen’s deep pockets promise.

In the end, the Mets are more than a baseball team — they are a financial powerhouse, a cultural symbol in New York, and a franchise reshaping the economics of the sport one blockbuster contract and record-setting season at a time.